Discover Well-Known hard money lenders in Atlanta Georgia Today

Discover Well-Known hard money lenders in Atlanta Georgia Today

Blog Article

Exactly how to Protect a Hard Money Loan: Actions to Simplify the Refine

Browsing the economic landscape can be tough, specifically when it involves safeguarding a Hard Money Loan. These loans, usually made use of in property transactions, call for a clear understanding of individual financial resources, the lending market, and open communication with prospective loan providers. The procedure may seem complex, yet with the best approach, it can be simplified and efficient. As we discover this topic additionally, you'll discover necessary actions to improve this monetary journey.

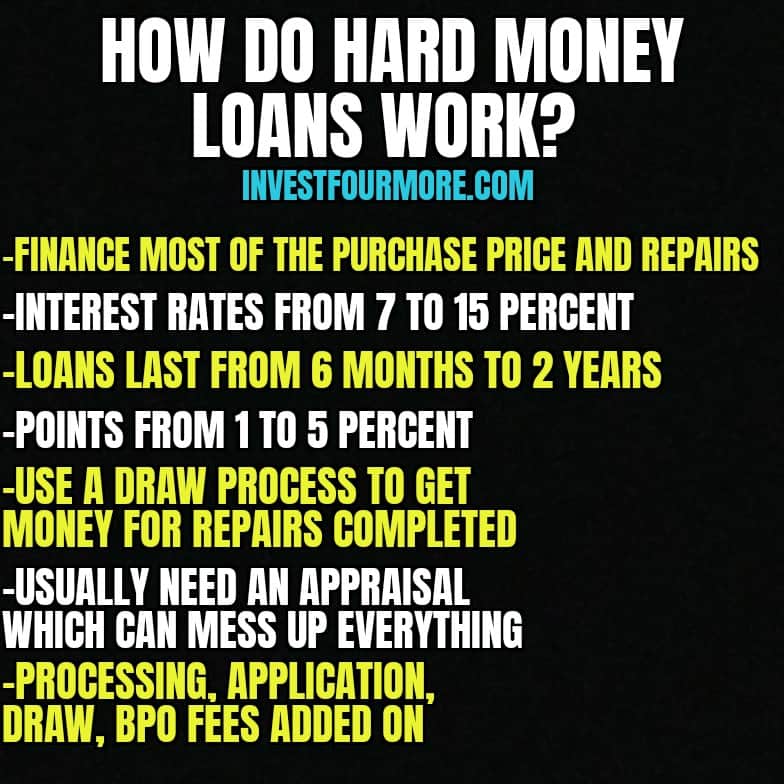

Comprehending What Hard Money Loans Are

Difficult Money car loans, usually seen as the economic life raft in the substantial sea of genuine estate, are an one-of-a-kind type of financing. Unlike conventional financial institution fundings, hard Money finances are not primarily based on the borrower's credit reliability but rather the value of the property being bought. Understanding these key attributes is essential in browsing the turbulent waters of difficult Money fundings.

Determining if a Hard Money Lending Is the Right Choice for You

Is a Hard Money Loan the best choice for you? Furthermore, if a quick closing procedure is critical, a Hard Money Lending can expedite proceedings, bypassing the prolonged authorization process typical loans demand. One must be conscious that difficult Money car loans commonly carry higher passion rates.

Preparing for the Financing Application Process

Prior to beginning on the process of safeguarding a Hard Money Loan, it's essential to appropriately prepare. Applicants should additionally be prepared to show their capability to make Financing settlements. It's suggested to conduct a complete home appraisal, as the worth of the residential or commercial property usually identifies the Finance amount.

Navigating Interest Rates and Loan Terms

Browsing rate of interest and Loan terms can be a complicated part of safeguarding a Hard Money Financing. Understanding rate of interest rates, understanding Finance terms, and negotiating favorable problems are crucial facets to consider. These elements, when effectively comprehended, can significantly influence the total expense and affordability of the Funding.

Comprehending Passion Prices

A significant majority of hard Money Lending applicants find themselves astonished by the complexities of rate of interest. These prices are paramount to recognizing the total cost of a loan, as they identify the extra quantity consumers have to pay back beyond the principal. In the context of hard Money lendings, rates of interest are normally greater than those of conventional car loans as a result of the inherent danger entailed. These financings are typically temporary, asset-based, and offer as a last option for customers who can not secure financing from standard lenders. For this reason, loan providers bill a costs in the form of high rate of interest rates to make up for the danger. Understanding these rates help consumers in evaluating if a Hard Money Funding is a sensible solution or if other financing choices would certainly be a lot more economical.

Figuring Out Lending Terms

Decoding the terms of a Hard Money Lending can frequently appear like a difficult task. Loan terms, commonly including the Lending amount, passion price, Funding duration, and payment routine, can substantially impact the borrower's financial commitments. The interest rate, usually greater in tough Money finances, is one more important component to take into consideration.

Negotiating Positive Conditions

Safeguarding desirable problems in a Hard Money Funding involves expert arrangement and an eager understanding of passion rates and Financing terms. A customer must not shy away from reviewing terms, wondering about stipulations, and suggesting adjustments.

Comprehending interest prices is pivotal. One need to be mindful of whether the price is fixed or variable, and just how it may change over the Funding term. It's vital to protect a rate of interest that lines up with one's financial abilities.

In a similar way, Loan terms need to be extensively analyzed. Facets like settlement schedule, early repayment fines, and default consequences have to be comprehended and worked out to stay clear of any type of future surprises.

Assessing and Selecting a Hard Money Lender

Selecting the appropriate difficult Money loan provider is a critical action in securing a financing. hard money lenders in atlanta georgia. It calls for recognizing the loan provider's standards, analyzing their level of openness, and considering their versatility. These aspects will certainly be taken a look at in the adhering to areas to direct people in making an educated decision

Comprehending Lenders Criteria

Inspecting Lenders Openness

This aspect is essential as it ensures that all Finance costs, terms, and conditions are plainly connected and quickly comprehended. It is recommended to request a clear, detailed composed proposal detailing all facets of the Finance agreement. In essence, the customer's capability to comprehend the Funding agreement considerably depends on the loan provider's openness.

Analyzing Lenders Versatility

Ever taken into consideration the significance of a lender's versatility when searching for a Hard Money Finance? Adaptability might manifest in various kinds, such as versatile Finance terms, willingness to work out fees, or approval of unique collateral. When protecting a Hard Money Loan, do not neglect the aspect of lender flexibility.

What to Expect After Securing Your Tough Money Financing

As soon as your difficult Money Finance is protected, a brand-new phase of the borrowing hard money lenders in atlanta georgia procedure starts. The consumer currently enters a settlement duration, which might differ relying on the specifics of the Financing contract. This period is generally temporary, varying from 12 months to a couple of years. It is important for the consumer to recognize the terms of the Financing, including the rate of interest and settlement routine, to stay clear of any kind of unpredicted problems.

In addition, hard Money financings usually come with higher rates of interest than conventional loans because of their integral risk. Therefore, timely payment is encouraged to reduce the price. Last but not least, it is very important to preserve an open line of communication with the loan provider throughout this phase, making sure any kind of problems are addressed immediately.

Verdict

In final thought, securing a Hard Money Loan involves understanding the nature of such loans, evaluating individual financial circumstances, and locating a suitable lending institution. These steps can assist individuals in securing and effectively managing a Hard Money Loan.

Browsing passion prices and Finance terms can be a complicated part of protecting a Hard Money Funding. In the context of hard Money car loans, interest rates are normally higher than those of traditional financings due to the intrinsic danger involved. Funding terms, typically including the Financing quantity, interest price, Finance period, and payment schedule, can dramatically impact the consumer's economic commitments.Securing beneficial visit this website problems in a Hard Money Finance involves skilful arrangement and an eager understanding of rate of interest prices and Finance terms.In final thought, securing a Hard Money Financing entails recognizing the nature of such fundings, evaluating individual monetary situations, and locating an appropriate lending institution.

Report this page